Car Loan in Canada: Complete Guide & Top 5 Companies

Buying a car in Canada often requires financial assistance, and that’s where car loans come in. Whether you are purchasing a new or used vehicle, understanding how car loans work in Canada can help you save money and make smarter decisions. In this article, we will explore how car loans function, eligibility, interest rates, and the top 5 companies offering the best car loans in Canada.

How Car Loans Work in Canada

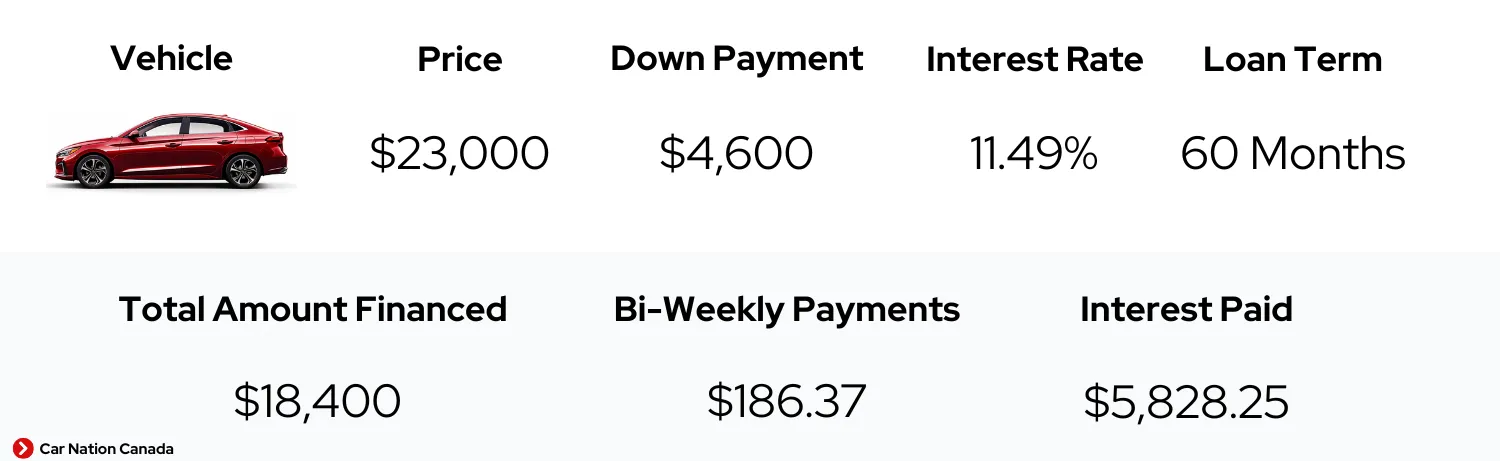

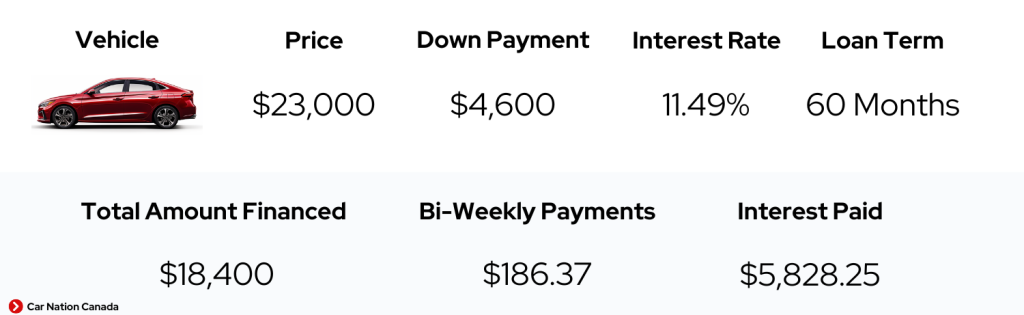

A car loan in Canada is a financing agreement between you and a lender (bank, credit union, dealership, or online lender). The lender pays for the vehicle upfront, and you repay the loan in monthly installments (EMIs) that include principal and interest.

- Loan Tenure: Usually 1 to 8 years.

- Interest Rate: Depends on credit score, income, and lender type (ranges from 5% to 15%).

- Down Payment: Often 10%–20% of car value is required.

- Eligibility: Canadian resident, stable income, valid driver’s license, and good credit history.

Factors That Affect Car Loan Approval

- Credit Score: Higher scores (700+) get lower rates.

- Employment History: Stable job increases approval chances.

- Debt-to-Income Ratio: Lower debt means higher approval probability.

- Down Payment: Bigger down payment reduces loan burden.

Benefits of Taking a Car Loan in Canada

- Immediate ownership of your dream car without full upfront payment.

- Flexible repayment options from 12 to 96 months.

- Builds your credit score with on-time payments.

- Special deals and incentives on dealer-financed loans.

Top 5 Car Loan Companies in Canada

1. RBC Royal Bank

Why Choose RBC? One of Canada’s biggest banks, RBC offers car loans with flexible repayment options and competitive rates.

- Interest Rates: Starting from 7% (variable).

- Loan Term: 1 to 8 years.

- Special Feature: Pre-approved auto financing available online.

2. TD Auto Finance

TD Bank provides auto loans for both new and used vehicles, including refinancing options.

- Interest Rates: Around 6%–12% depending on credit profile.

- Loan Term: 12 to 96 months.

- Special Feature: Wide dealer network for seamless financing.

3. Scotiabank

Scotiabank is known for competitive auto loan products and refinancing options in Canada.

- Interest Rates: Typically 5.99% and above.

- Loan Term: Up to 96 months.

- Special Feature: New immigrant auto loans program.

4. CIBC Auto Loans

CIBC provides customized financing solutions for individuals with good credit as well as first-time buyers.

- Interest Rates: Starts near 6.5% (depends on credit history).

- Loan Term: Flexible from 1 to 8 years.

- Special Feature: Early repayment option without penalty.

5. Desjardins Group

A popular credit union in Quebec and across Canada, Desjardins offers competitive vehicle loan products.

- Interest Rates: Usually 6%–10%.

- Loan Term: Up to 8 years.

- Special Feature: Extra benefits for Desjardins members.

Tips to Get the Best Car Loan in Canada

- Check Your Credit Score: Aim for 700+ for better rates.

- Shop Around: Compare banks, credit unions, and online lenders.

- Negotiate Loan Terms: Shorter tenures may cost less in interest overall.

- Consider Pre-Approval: Helps you budget better before visiting dealerships.

Conclusion

Car loans in Canada make owning a vehicle easier by offering flexible repayment options and competitive interest rates. By comparing lenders like RBC, TD, Scotiabank, CIBC, and Desjardins, you can choose the one that fits your budget and needs. Always check your credit score, compare terms, and negotiate before signing a loan agreement.

Disclaimer: Loan terms and rates mentioned are approximate and may vary depending on location, credit score, and lender policies. Always confirm with the bank before applying.

Complete Car Loan Guide for Canada & USA

Looking for the best auto loan rates? This guide covers car financing options in both Canada and the USA. Learn how to get low interest car loans, compare lenders, and apply online with ease.

Country-Specific Car Loan Guides

- Car Loan Guide – Canada (covers bank car loan offers and credit union car loans)

- Car Loan Guide – USA (includes auto loan refinancing and pre-approved auto loan tips)

Why Trust This Car Loan Guide?

We reference trusted resources like Ratehub’s Canadian car loan rankings and NerdWallet’s U.S. auto loan analysis. These comparisons provide real-time information on compare car loan rates and vehicle financing for bad credit.

How to Use This Guide

Step 1: Choose Your Country

Select Canada or USA for tailored details on online car loan application steps.

Step 2: Learn Eligibility

Check credit score requirements, down payment expectations, and loan terms for low interest car loans.

Step 3: Compare & Apply

Review lender offers, auto loan refinancing options, and repayment periods before applying.

Pro Tips for Smart Car Financing

- Check your credit score—higher scores unlock low interest car loans.

- Get a pre-approved auto loan—gives you more bargaining power.

- Compare car loan rates—across banks, credit unions, and online lenders.

- Watch out for markups—dealer financing may cost more than bank car loan offers.

Disclaimer: Loan terms and rates vary by lender, credit score, and location. Always confirm details directly with the financial institution before applying.